Which Stock Market API Offers the Most Accurate Historical Data?

Accurate historical data is the backbone of financial research, algorithmic trading, investment strategy development, and market intelligence. Whether you’re building a quant model, analyzing long-term market trends, or powering a trading platform, the quality and accuracy of the historical stock data you consume directly influence the outcomes of your analysis.

And with hundreds of stock market data providers claiming to offer “accurate data,” choosing the right one is not easy.

This guide breaks down everything you need to know, how historical data works, what accuracy really means, which APIs provide the best long-term stock market chart history, and why TagX Stock Market API stands out as a reliable provider of global historical market data.

What Exactly Is Historical Market Data?

Historical market data refers to the past price movements and market activity of a stock, ETF, index, option, or any tradable security.

This includes:

- Historical stock prices (Open, High, Low, Close - historical OHLC data)

- Intraday data (1-minute, 5-minute, 15-minute intervals)

- End-of-day market data (EOD)

- Tick-level data

- Corporate action-adjusted pricing

- Historical option prices

- Volume and trade activity

- Long-term stock market chart history

These datasets are the foundation for:

- Backtesting strategies

- Predictive modelling

- Portfolio analysis

- Quantitative research

- Risk management

- Market trend analysis

- Financial time-series modelling

- Building dashboards and investor tools

Every financial system- from Bloomberg terminals to retail trading app- relies heavily on accurate historical stock data APIs.

Why Accurate Historical Data Matters More Than Ever

There are three major reasons why accuracy in historical stock data is critical.

A. Small Errors Lead to Big Financial Losses

Even a minor inaccuracy in historical OHLC data can:

- Distort backtesting results

- Misleading trend analysis

- Trigger false entry/exit signals

- Break algorithmic trading models

If you're analysing 500,000 data points, a tiny inconsistency compounds into completely wrong strategy outcomes.

B. Quant Teams Depend on Clean, Corporate-Action-Adjusted Data

Corporate actions such as:

- Stock splits

- Reverse splits

- Dividends

- Bonus issues

- Rights issues

- Mergers & acquisitions

must be accurately adjusted in historical datasets.If not, long-term chart history becomes unusable for modelling.

C. Modern Financial Apps Need Multi-Exchange Reliability

Today’s apps, brokers, portfolio trackers and investor tools operate globally.

They need:

- Multi-exchange data coverage

- Global exchange listings

- Historical option prices

- Long-term datasets

- Accurate stock market chart history

In short: accuracy isn’t optional, it’s the core of trustworthy financial platforms.

Who Needs Accurate Historical Stock Data the Most?

Accurate historical data is not just for large financial institutions. A wide range of industries depend on high-quality stock market historical data to power decision-making, research, and product features.

Quant Teams & Algorithmic Traders

They use historical OHLC data, intraday feeds, and long-term pricing history to build, test, and refine trading strategies. Even a small error can create false signals.

Fintech Platforms & Investment Apps

Portfolio trackers, advisory platforms, and charting tools need stable end-of-day market data and multi-exchange coverage to deliver reliable insights to users.

Financial Analysts & Research Firms

Analysts require clean financial time-series data to study long-term market trends, sector performance, and pricing patterns across global markets.

Academic Researchers

Universities and economic researchers use historical stock prices and historical option prices to study market behaviour, volatility, and pricing efficiency.

Data Science & Machine Learning Teams

ML models depend on large, accurate datasets for training. Data errors lead to inaccurate predictions and unreliable outputs.

What Makes a Stock Market API Accurate?

Not all stock market historical data providers follow the same standards. To find the best API for accurate historical stock data, you must evaluate these factors:

Data Source Quality

The most reliable source for historical stock price lookup always comes from:

- Official exchanges

- Verified market data vendors

- Regulated data sources

APIs relying on free, scraped, or aggregated public feeds often have:

- Missing data

- Wrong timestamps

- Incorrect OHLC values

- Gaps in intraday data

Corporate Action Adjustments

Accurate historical stock data must correctly apply:

- Split adjustments

- Dividend adjustments

- Consolidations

- Symbol changes

- Delisting adjustments

These ensure long-term chart history remains correct.

Intraday Resolution Reliability

A strong API should provide:

- 1-minute data

- 5-minute data

- 15-minute data

- Hourly data

- EOD data

- Tick-by-tick data (if available)

With no gaps or corrupted intervals.

Data Review & Error Correction

Good providers maintain:

- Quality control systems

- Data correction logs

- Automated anomaly detection

- Human-in-the-loop validation

This ensures data reliability for analysts and protects your models from inaccuracies.

Global Coverage

A reliable API for global historical market data should include:

- US exchanges

- European markets

- APAC markets

- Middle Eastern markets

- Emerging markets

Plus ETFs, indices, and options.

Consistency Across All Symbols

Accurate data must maintain:

- Uniform timestamp formats

- Consistent time zones

- Stable price scaling

- Matching volume units

Inconsistent formatting can break downstream systems.

Comparison of Top Stock Market APIs for Historical Data

Below is a comparison you can use to evaluate the most trusted APIs.

| API Provider | Historical Data Accuracy | Corporate Action Adjustments | Intraday Data | Global Exchanges | Options Data | Best For |

| TagX Stock Market API | Very High | Fully Adjusted | 1m, 5m, 15m, EOD | Global | Yes | Analysts, fintech apps, platforms needing long-term datasets |

| Polygon.io | High | Fully Adjusted | High quality | Mostly US | Yes | US algo trading |

| Alpha Vantage | Medium | Partial | Limited | Global | No | Beginners |

| Yahoo Finance Free Data | Low–Medium | Inconsistent | Unreliable | Global | No | Basic analysis |

| Twelve Data | Medium | Partial | Good | Global | No | Dashboards and simple tools |

From this, TagX stands out as:

- A clean historical data provider

- Offering global multi-exchange market coverage

- With high accuracy levels

- And access to historical options and stock data in one API

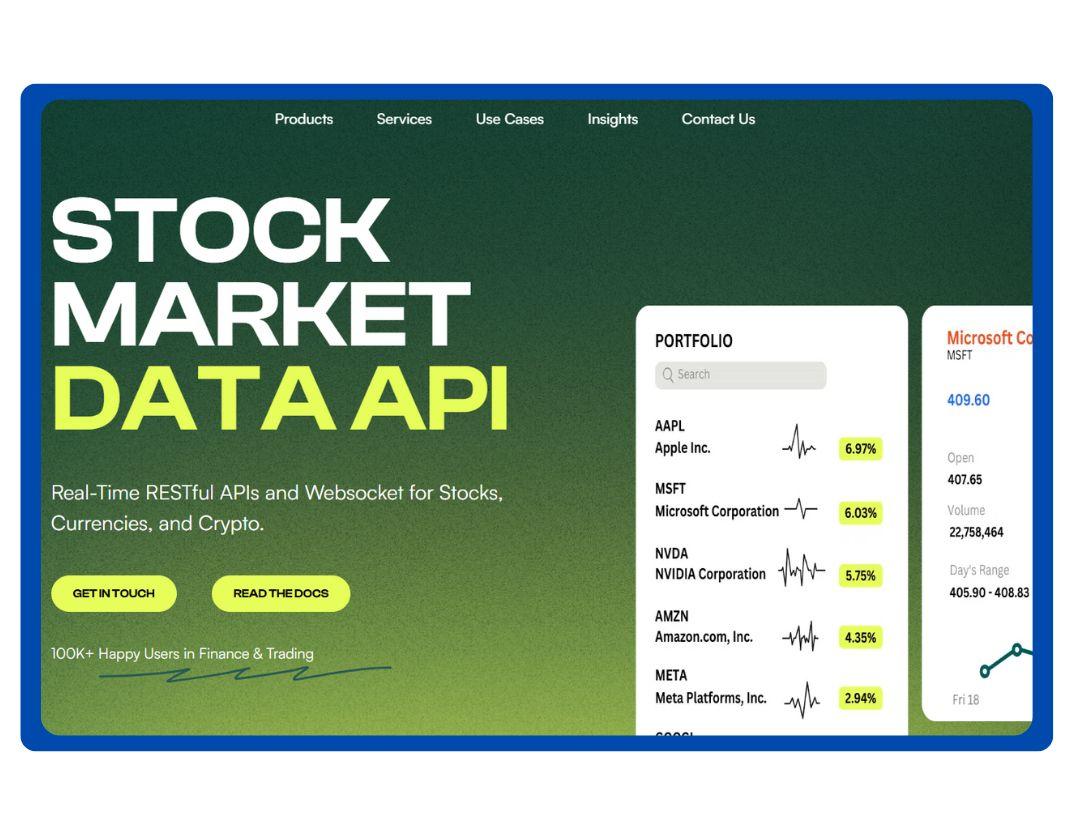

TagX Stock Market API (Recommended for Accurate Global Historical Data)

TagX Stock Market API

Global Coverage with Accurate Historical Data

TagX provides historical stock data from major global exchanges, including delayed datasets designed for research, dashboards, and insights without the high cost of real-time feeds. Coverage spans:

- US

- Europe

- Asia-Pacific

- Middle East

- Emerging markets

This makes TagX ideal for teams looking for an API for global historical market data.

Long-Term Stock Market Chart History

TagX maintains long-term financial time-series data with:

- Full historical OHLC data

- Gaps removed

- Timestamps normalized

- Corporate actions applied

- Stable and consistent EOD datasets

Intraday + EOD Coverage

TagX supports:

- 1-minute interval data

- 5-minute and 15-minute intraday datasets

- End-of-day historical stock prices

This makes it suitable for backtesting datasets, quant models, and financial dashboards.

Historical Options & Equity Data in One API

TagX provides:

- Historical option prices

- Option chain history

- Equity pricing history

- Multi-year EOD data

- Global delayed market data

This reduces your need for multiple vendors.

Data Reliability & Validation

TagX uses:

- Automated anomaly detection

- Data correction workflows

- Human-in-the-loop validation

- Duplicate detection

- Error sanitization

ensuring high accuracy for analysts and developers.

Explore further: https://tagxdata.com/top-7-stock-market-apis-for-developers-and-businesses

How To Choose the Best API for Accurate Historical Stock Data

Here’s a simple checklist to evaluate any provider:

1. Check the Source of Historical Data

Ask:

- Does the provider source data directly from exchanges?

- Are feeds regulated or scraped?

- Is the data verified?

2. Verify Corporate Action Accuracy

Ask:

- Are dividends applied correctly?

- Are stock splits adjusted?

- Are delistings handled?

Poor adjustments completely distort long-term market trends.

3. Inspect Data Depth

Check for:

- 10+ years of historical stock prices

- Multi-decade data for indices

- Intraday history availability

- Tick-level data (if needed)

4. Confirm Completeness

Look for:

- No missing intervals

- No corrupted candles

- Reliable volume reporting

- Time zone consistency

5. Check Documentation & Performance

A good API should offer:

- Fast response times

- Low latency

- Clear endpoints

- Pagination for bulk data

- Sample code & SDKs

6. Confirm Global Exchange Coverage

Ask:

- Are Japan, India, UK, Germany, US covered?

- Are ETFs and indices included?

- Are options included?

Multi-exchange data coverage is essential for global apps.

Dive deeper: https://tagxdata.com/10-must-have-financial-apis-for-real-time-market-tracking-in-2025

How To Access Historical Stock Prices Through an API (Step-by-Step)

Step 1: Get an API Key

Sign up on the provider’s dashboard.

Step 2: Choose Your Endpoint

Common endpoints for historical data include:

- /historical/stock

- /historical/intraday

- /eod

- /options/historical

Step 3: Define Your Parameters

You’ll typically provide:

- Symbols (AAPL, TSLA, NIFTY50, etc.)

- Exchange

- Date range

- Interval (1m, 5m, daily)

Step 4: Retrieve the Data

The API returns structured JSON with:

- Open

- High

- Low

- Close

- Volume

- Timestamp

- Corporate action adjustments

Step 5: Store or Visualize the Data

Most users integrate data into:

- Trading dashboards

- Machine learning models

- Portfolio analysis systems

- Backtesting tools

- Quant frameworks

Which API Offers the Most Accurate Historical Data?

Based on:

- Data accuracy

- Corporate action reliability

- Historical depth

- Intraday completeness

- Global coverage

- Options data availability

- Data validation reliability

TagX Stock Market API ranks as one of the most accurate global providers of delayed historical market data.

- Polygon offers great US data.

- Alpha Vantage is good for beginners.

- Yahoo Finance is best for casual use but not reliable for quant work.

For teams needing:

- Clean global historical stock data

- Historical OHLC datasets

- Long-term stock market chart history

- Reliable backtesting datasets

- Corporate action accuracy

- Both equity & options historical data

TagX provides the strongest balance of accuracy, affordability, and multi-exchange coverage.

Conclusion

Accurate historical data is essential for anyone analyzing markets, testing strategies, or building financial tools. When historical stock prices, historical option prices, or long-term chart history are unreliable, every insight becomes weaker.

A dependable stock market historical data provider ensures that your financial time-series data is complete, consistent, and ready for analysis. This accuracy supports better decisions and stronger models.

TagX Stock Market API delivers clean global historical market data, covering stocks and options across 100+ exchanges. With reliable historical OHLC data and stable stock market data feeds, it helps teams work with confidence.

Ready to access accurate historical stock data for your strategies and research? Contact TagX today and get reliable, global datasets delivered via a powerful API.

Frequently Asked Questions

What is the most reliable source for historical stock price lookup?

A trusted stock market historical data provider like TagX Stock Market API offers validated datasets, global exchange coverage, and accurate corporate action adjustments. Using a reliable source ensures your historical stock data and financial time-series data are precise and ready for analysis.

How can I access historical stock prices through an API?

You can access historical stock prices through APIs by signing up for a key, choosing the data type (stocks, options, indices), selecting your date range, and querying the endpoint in your preferred format (JSON, CSV, or Excel).

Can I get both historical stock prices and historical option prices in one API?

Yes. Some APIs, like TagX Stock Market API, provide both historical stock prices and historical option prices in one system, making it easier for analysis and backtesting.

Which API provides long-term stock market chart history?

The best API for accurate historical stock data offers long-term OHLC data, adjusted for corporate actions, with multi-exchange coverage. TagX API provides decades of global historical stock and options data for this purpose.

What is historical OHLC data and why is it important?

Historical OHLC data includes Open, High, Low, and Close prices for a security over time. It’s essential for technical analysis, backtesting trading strategies, and building quantitative research datasets.

How do I ensure data reliability for analysts?

Choose a stock market historical data provider that uses verified sources, applies corporate action adjustments, maintains consistent timestamps, and offers error correction and validation processes.

Can historical stock data be used for backtesting strategies?

Absolutely. Accurate historical stock data, including historical option prices and end-of-day market data, is crucial for creating reliable backtesting datasets and simulating trading strategies.

Does the API cover global exchanges?

Yes. Leading APIs for global historical market data provide multi-exchange coverage, including US, European, and Asia-Pacific markets, ensuring analysts have a comprehensive dataset.